GAP Insurance Infographic: The Hidden Pitfall In Car Finance Deals

Car Finance Is Booming

There has been a massive surge in motorists using personal contract purchase (PCP) deals to buy new cars. Last year, 87% of cars were bought on finance, up from 81% in 2015* and an increase of 50% from 2009, leaving UK drivers with a debt of £58 billion in car finance.**

PCP deals allow motorists to have a new car for a few years, in return for monthly payments. At the end of the term – typically 3-5 years – they have the option to pay the remainder and own the car or simply hand it back.

Motorists locked into appealing finance deals on new cars could be leaving themselves open to huge bills if the car is written off or stolen before the end of the agreed loan period.

What If?

With 500,000 vehicles beyond repair written off in accidents each year and a further 200,00 are stolen, this is a very real issue. MotorEasy believes that very few consumers with PCP deals understand the implications to them if this happens before the end of their agreement.

The prevalence of PCP deals is causing increasing concern for the motor industry, as there has been a rise in motorists taking out loans on new cars and defaulting on payments. The amount of debt owed by consumers on car finance has risen 15% in the last 12 months.

The ‘protection’ offered by a PCP deal only comes at the end of the agreed term. If the vehicle is written off or stolen beforehand, insurance companies typically only pay the market value of the car at that point.

GAP Insurance Protection

That could be significantly less than the finance settlement figure at the same point, leaving the motorist with a financial shortfall and a hefty bill to pay off the finance. MotorEasy’s GAP insurance covers the difference between the vehicle market value and the remaining amount of the finance settlement.

GET A FINANCE GAP INSURANCE QUOTE

What is GAP Insurance?

Depreciation means cars lose value very quickly, so if your car is written off or stolen you can be out of pocket.

On average a car loses around 60 per cent of its value in three years (the typical length of a PCP).

So, if your new car costs £12,000 and three years later it was stolen or written off, you’d get just £4,800 from your insurer.

That’s not enough to buy the same car brand new and it’s unlikely to be enough to repay the remaining finance – due to balloon payments and interest on PCP deals.

Gap insurance will cover the difference between what your insurer pays out and, depending on the type of policy, what you paid for the car or what you still owe on the car.

That’s why GAP insurance focuses on new vehicles rather than older models as the rate of depreciation is much lower on a used car.

GET A FINANCE GAP INSURANCE QUOTE

MotorEasy founder, Duncan McClure Fisher, said: “PCP deals are a great way of financing a new car but motorists should be made aware that it is simply a standard hire purchase agreement, with a deferred settlement figure.

“Before that settlement figure is paid at the end of the agreement, you are just as exposed as with any other finance arrangement.”

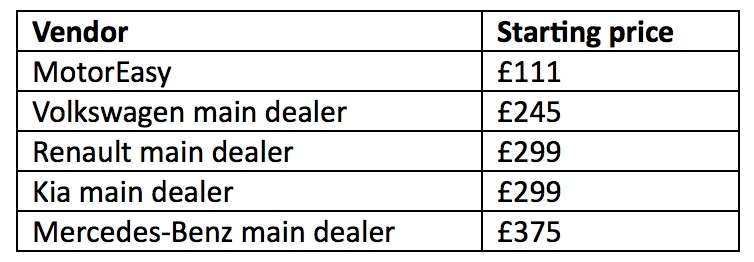

MotorEasy GAP insurance starts at £63 for a one-year policy, reflecting a huge saving on the same product offered by main dealers.

We've put in the leg work for you with a price comparison against some UK main dealers below, illustrating the significant GAP Insurance savings available.

So get in touch to protect your car's value against depreciation, and to avoid being left owing thousands of pounds to your finance company in the event of theft or writeoff.

Protect The GAP In Your Car Finance

MotorEasy can also save you money on repairs with the UK's best car warranty, as well as your maintenance with manufacturer servicing and MOT tests